In the ever-evolving world of cryptocurrencies, Bitcoin remains the predominant leader, showcasing its dominance as the number one cryptocurrency on CoinMarketCap.

As of today, the live Bitcoin price hovers at $26,244, having registered a slight dip of 0.5% over the last 24 hours. This comes amidst a robust 24-hour trading volume of $11 billion.

With a circulating supply of 19,497,568 BTC coins out of its max supply of 21,000,000, and a commanding live market capitalization of $511 billion, the crucial question arises: What’s the next strategic move for BTC?

Bitcoin Price Prediction

From a technical standpoint, Bitcoin exhibits a bullish bias, especially after its recent inability to sustain above the $26,750 mark. Observing the four-hourly timeframe, Bitcoin bounced off its support near $26,000, a pivotal level that doubles as a psychological anchor for BTC.

Notably, the $26,779 level posed as a formidable barrier, displaying characteristics of a double top pattern, which subsequently provided staunch resistance.

Having been unable to breach the $26,779 threshold, Bitcoin retraced, relinquishing its recent gains, yet maintaining above the $22,000 support level.

BTC’s outlook remains optimistic while it stays above the $26,000 support. Should it fall beneath this mark, Bitcoin could seek the subsequent support levels at $25,400 and, further down, $24,900, which is expected to serve as a vital cushion.

Conversely, if Bitcoin sustains above the trend line support of $26,000, the resistance at $26,750 will be the next focal point. A breakthrough here could set the stage for a target near the $27,450 level.

In terms of leading and lagging indicators, there seems to be a mixed sentiment among investors. The 50-day exponential moving average (EMA) is hovering around the $26,300 level, and BTC’s price frequently fluctuates around it.

Concurrently, the Relative Strength Index (RSI) sits in a sell zone, while the Moving Average Convergence Divergence (MACD) presents bullish cues.

In light of these dynamics, investors should closely monitor the $26,000 level, which is poised to act as a pivotal point—dictating bullish prospects above and bearish tendencies below for Bitcoin price.

Let’s take a closer look at Bitcoin Minetrix, an alternative to Bitcoin that has been making headlines recently.

Bitcoin Minetrix (BTCMTX) – Alternative Coins to Invest In

Bitcoin Minetrix ($BTCMTX) emerges as a promising new contender in the realm of cryptocurrency presales, marking its unique identity as a pioneering stake-to-mine venture.

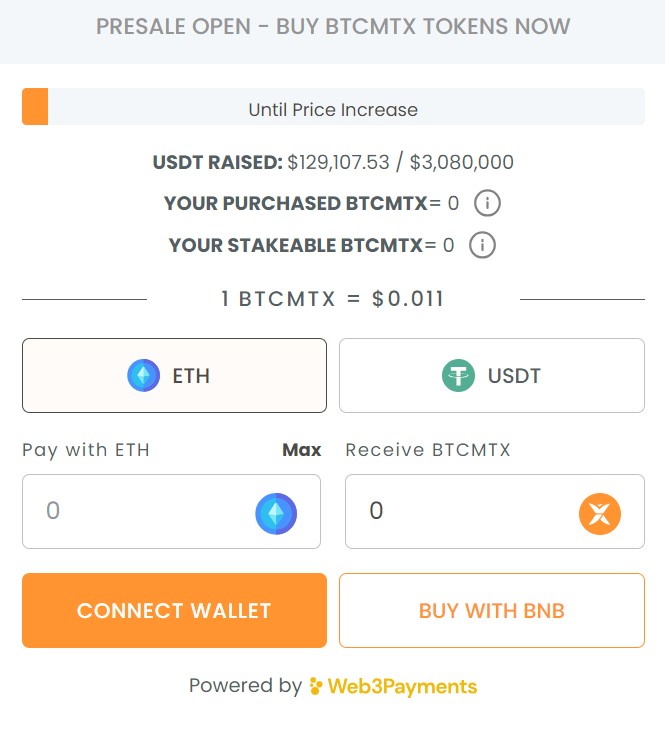

Despite being in its nascent stages, it has managed to garner over $100,000 in its presale, offering investors the dual advantage of staking tokens for substantial annual percentage yields (APY) and participating in cloud mining to earn BTC rewards.

Distinguishing itself from contemporaneous cloud mining initiatives, Bitcoin Minetrix ensures accessibility through its notably low entry point of just $10, coupled with enhanced security features.

But, what exactly is Bitcoin Minetrix?

Bitcoin Minetrix stands as a novel stake-to-mine initiative where enthusiasts can stake their BTCMTX tokens to accumulate credits. These credits can subsequently be utilized for cloud mining durations.

This innovative model democratizes the mining process, enabling token holders to reap BTC rewards through mining – a domain conventionally dominated by corporations with multi-million-dollar infrastructures due to the exorbitant costs and energy requirements of mining operations.

The ongoing Bitcoin Minetrix presale is in full swing, with the token priced at $0.011 during its initial phase, which is set to rise by 8% to $0.0119 by its conclusion.

The total token supply caps at 4 billion, with a staggering 70% (2.8 billion) up for grabs during the presale, contingent on its performance. Investment milestones have been demarcated with a soft cap of $15.6 million for 1.4 billion tokens, and an ambitious hard cap of $32 million if the presale witnesses a complete sell-out.